3 Simple Techniques For Business Debt Collection

Wiki Article

A Biased View of Debt Collection Agency

Table of ContentsPrivate Schools Debt Collection for DummiesPrivate Schools Debt Collection Fundamentals ExplainedThe Buzz on Private Schools Debt CollectionHow Private Schools Debt Collection can Save You Time, Stress, and Money.

:max_bytes(150000):strip_icc()/debt-validation-requires-collectors-to-prove-debts-exist-960594-V1-a13dc2e2066f49c38ebc05f515de9492.jpg)

The financial debt customer acquires just a digital documents of details, often without supporting evidence of the debt. The financial debt is likewise normally very old financial obligation, in some cases referred to as "zombie financial debt" since the financial obligation customer tries to restore a financial obligation that was beyond the law of restrictions for collections. Financial debt debt collector may contact you either in writing or by phone.

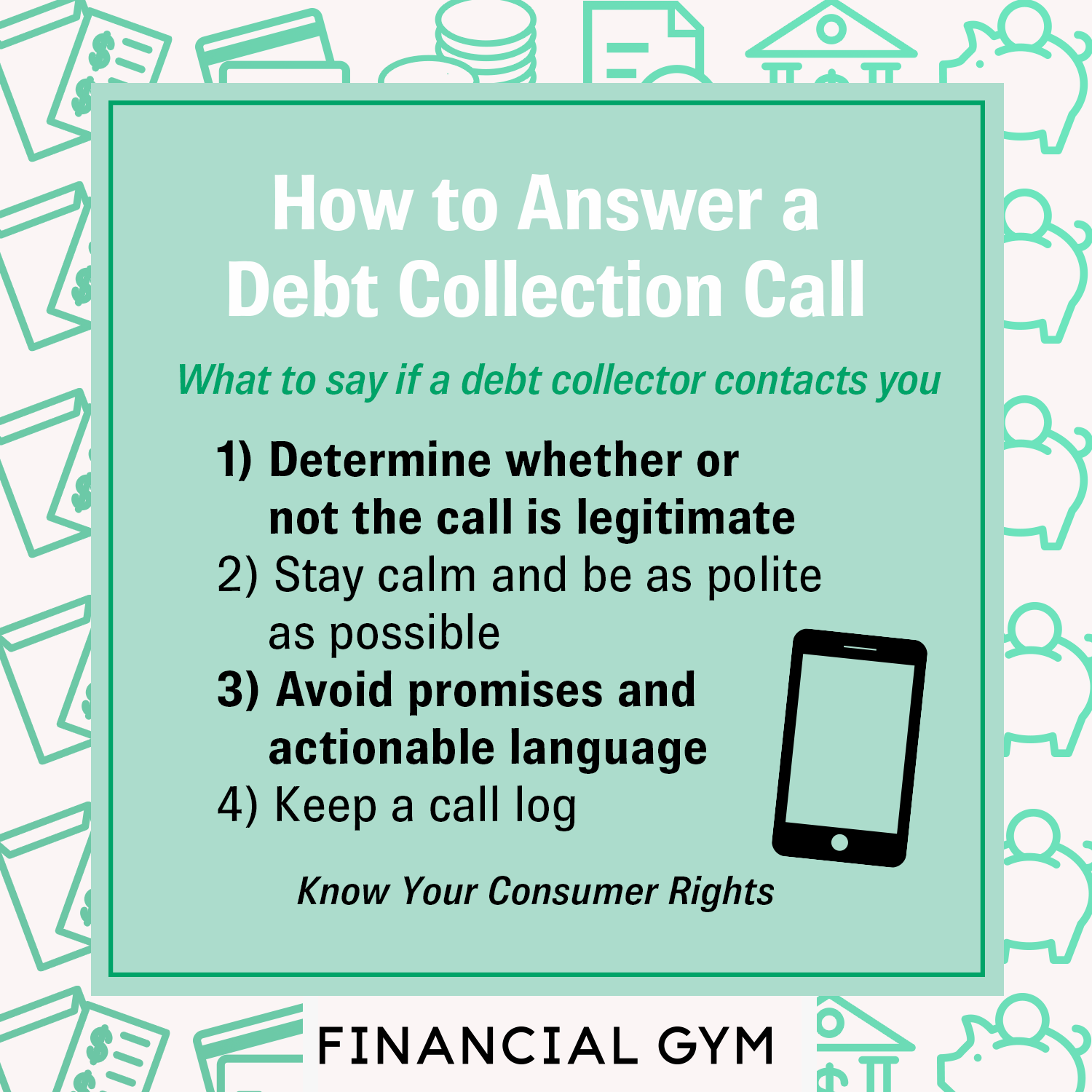

Yet not talking with them will not make the financial obligation disappear, and they might just attempt different methods to contact you, including suing you. When a financial debt enthusiast calls you, it's vital to obtain some preliminary information from them, such as: The financial obligation collector's name, address, as well as telephone number. The total quantity of the financial debt they declare you owe, including any type of fees as well as passion fees that might have accrued.

The smart Trick of Private Schools Debt Collection That Nobody is Discussing

The letter should state that it's from a financial debt collection agency. They have to additionally educate you of your legal rights in the financial debt collection process, and also exactly how you can dispute the financial debt.If you do dispute the debt within thirty days, they have to discontinue collection initiatives until they offer you with evidence that the financial obligation is your own. They must provide you with the name and address of the original financial institution if you request that details within 1 month. The debt validation notification have to include a type that can be used to call them if you wish to dispute the debt.

Some points financial obligation collectors can refrain are: Make repeated telephone calls to a debtor, planning to annoy the borrower. Intimidate physical violence. Use obscenity. Lie regarding just how much you owe or pretend to call from an official government office. Normally, debt is reported to the check my blog credit score bureaus when it's 30 days overdue.

If your debt is moved to a debt collection agency or offered to a financial obligation purchaser, an entrance will certainly be made on your credit score record. Each time your financial obligation is sold, if it continues to go unpaid, another entrance will certainly be included in your credit score record. Each negative entrance on your credit rating report can stay there for up to seven years, even after the debt has actually been paid.

Debt Collection Agency for Beginners

What should you anticipate from a collection company and also how does the procedure work? When you have actually made the decision to employ official site a collection firm, make sure you select the best one.Some are much better at obtaining outcomes from larger companies, while others are experienced at accumulating from home-based organizations. Make certain you're dealing with a business that will in fact serve your needs. This might seem obvious, but before you hire a collection agency, you need to make certain that they are certified and accredited to serve as financial obligation collection agencies.

Prior to you begin your search, recognize the licensing demands for debt collection agency in your state. By doing this, when you are interviewing firms, you can speak smartly about your state's demands. Examine with the companies you talk to to guarantee they fulfill the licensing demands for your state, specifically if they are located in other places.

You ought to additionally contact your Better Organization Bureau as well as the Commercial Collection Agency Organization for the names of reputable and also highly related to debt collection agencies. While you might be passing along these financial obligations to an enthusiast, they are still representing your firm. You need to understand how they will represent you, just how they will deal with you, and also what appropriate experience they have.

Our International Debt Collection Diaries

Even if a technique is lawful does not indicate that it's something you desire your firm name related to. A reputable financial obligation collector will certainly function with you to set out a plan you can live with, one that treats your previous consumers the method you 'd intend to be treated and also still finishes the job.If that occurs, one tactic numerous agencies view it now make use of is skip tracing. You need to likewise dig into the collector's experience. Relevant experience increases the likelihood that their collection initiatives will certainly be effective.

You ought to have a point of call that you can connect with as well as receive updates from. Business Debt Collection. They should have the ability to plainly articulate what will be anticipated from you in the process, what info you'll require to give, and what the cadence and activates for communication will be. Your chosen agency must have the ability to suit your selected communication demands, not force you to accept their own

Ask for evidence of insurance policy from any kind of collection company to protect on your own. Financial debt collection is a solution, and also it's not a low-cost one.

Report this wiki page